by Robert Romano

Don’t look now, but if you were planning on a severe recession and a spike in unemployment before the 2020 elections in the hopes it would help oust President Donald Trump, you might have to keep waiting.

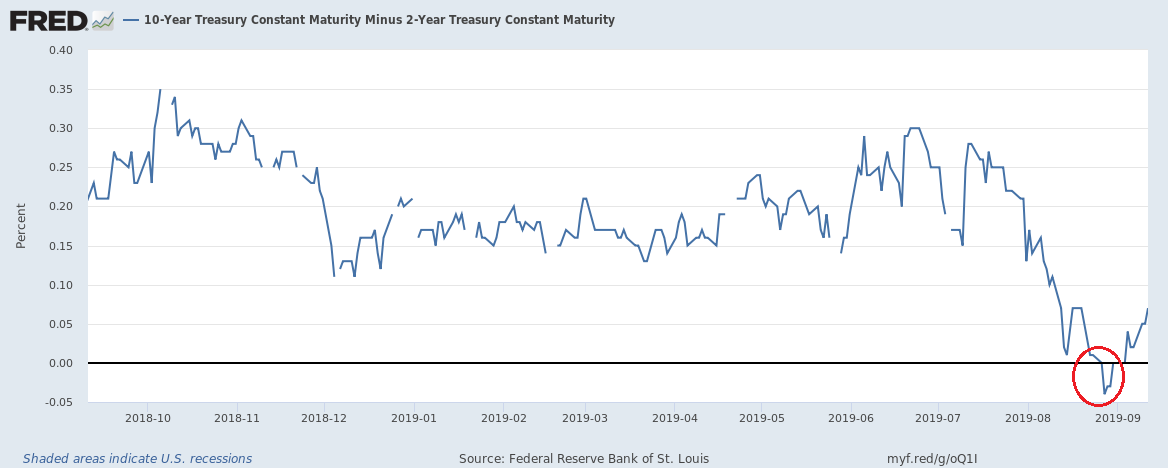

The spread between 10-year and 2-year treasuries, the one that inverted in late August for a few trading days, thought to be a fairly reliable predictor of a recession on the horizon and certainly was widely reported as such, un-inverted on Sept. 4 without the same fanfare.

That’s too bad, because a lot of people could be getting this story wrong.

Usually, interest rate inversions between the long and short interest rates like the 10-year, 2-year go fairly deep into negative territory for weeks and months as a certain recession signal on average about 16 months after the inversion, but in this case, the inversion was extremely shallow and only lasted for six trading days.

So, was it a false signal?

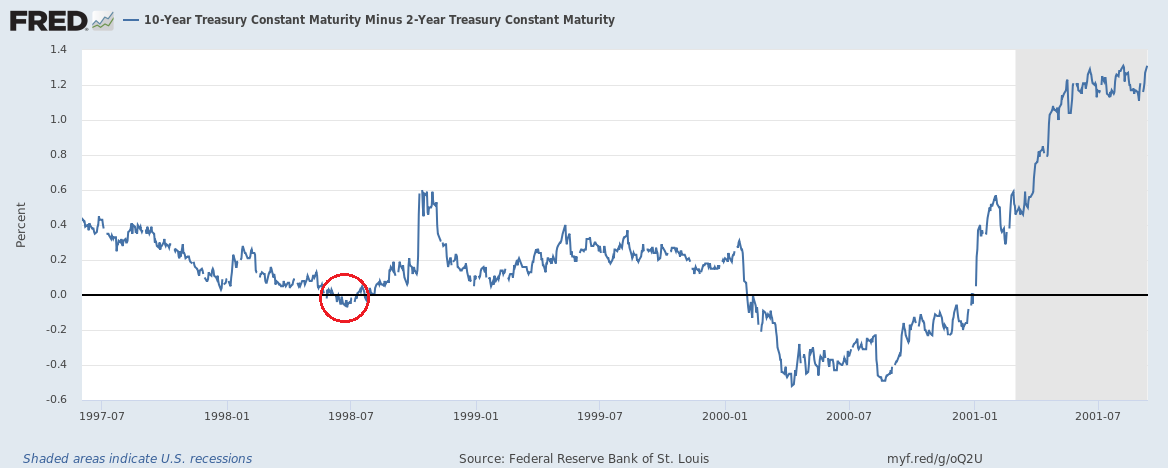

The short answer is we don’t know yet. It could invert again today as it is not too far in positive territory since we are in fact nearing the end of the business cycle. But a hint could come from the month-long, shallow inversion between the 10-year, 2-year that occurred in 1998 that turned out to be too early to predict the March 2001 recession.

Then, the Federal Reserve acted quickly to cut interest rates, the inversion was cured and it turned out the boom economy of the 1990s had a couple of years left on it.

The same thing might be happening here. The central bank already cut the federal funds rate in its July meeting, and for the Sept. 17 and 18 Fed meetings, markets area expecting another rate cut amid strong dollar concerns. President Donald Trump has been saying interest rates are too high since last October and has been complaining about the dollar being too strong and flattening U.S. exports. He’s not wrong. On a trade-weighted basis, the U.S. dollar has never been stronger versus foreign currencies, and it has most certainly had a negative impact on U.S. bids to trade overseas as In periods when the dollar was weakening, U.S. exports have tended to accelerate, and in periods where it strengthened, exports slowed down or even contracted.

Adding to expectations for a rate cut, on Sept. 11, the President even called for negative interest rates, writing on Twitter, “The Federal Reserve should get our interest rates down to ZERO, or less, and we should then start to refinance our debt. INTEREST COST COULD BE BROUGHT WAY DOWN, while at the same time substantially lengthening the term. We have the great currency, power, and balance sheet… The USA should always be paying the… lowest rate. No Inflation! It is only the naïveté of Jay Powell and the Federal Reserve that doesn’t allow us to do what other countries are already doing. A once in a lifetime opportunity that we are missing because of ‘Boneheads.’”

Here, Trump is referring to negative interest rates offered in countries like Germany and Japan, which artificially keep their interest rates lower than U.S. rates to incentivize purchases of U.S.-dollar-denominated assets like treasuries, which keeps the dollar strong, and the euro and yen weak to boost exports to the U.S.

On the flip side, negative rates also seem to foreshadow weaker economic growth and overall deflationary conditions. It wouldn’t necessarily be a positive thing to see them, anymore so than quantitative easing.

If interest rates go negative it will mean a world of perverse incentives (like earning interest by going deep into debt), but markets may leave the U.S. with little choice in the matter. As large as government and other debts are, and they number in the tens of trillions, there is simply far more demand for bonds than there is a supply, and so if markets push rates negative, the Fed will be left with a choice than to leave the federal funds rate inverted perhaps for years or to plunge into negative territory and start paying banks interest to borrow at the discount window.

Barring other mechanisms for weakening the dollar — the Fed could sop up foreign currencies along with the U.S. Treasury in so-called warehousing operations — interest rate cuts may be the only game in town that matters at the moment. Now everyone has to hold their breath and wait to see what the Fed does next week.

– – –

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.